Railway NTPC Vacancy 2024: रेलवे में एनटीपीसी के लिए बंफ़र पदों पर भर्ती, आवेदन शुरू

Railway NTPC Vacancy 2024: जो भी छात्र लंबे समय से रेलवे में एनटीपीसी पदों पर भर्ती का इंतजार कर रहे ...

Read more

MCL Vacancy 2024 : महानदी कोलफील्ड्स लिमिटेड में निकली भर्ती जल्द करे आवेदन

MCL Vacancy 2024 MCL Vacancy 2024 :- महानदी कोलफील्ड्स लिमिटेड (Mahanadi Coalfields Limited) ने Offline माध्यम से के लिए आवेदन पत्र आमंत्रित किया है। ...

Read more

SBI Job 2024 For Freshers : Recruitment, Notification, Exam Date, Apply Online, Eligibility, Admit card

SBI Job 2024 For Freshers के लिए आप इस सरकारी नौकरी अधिसूचना Cg Govt Jobs News से संबंधित सभी जानकारीजैसे वेतनमान, शैक्षणिक योग्यता, आयु ...

Read more

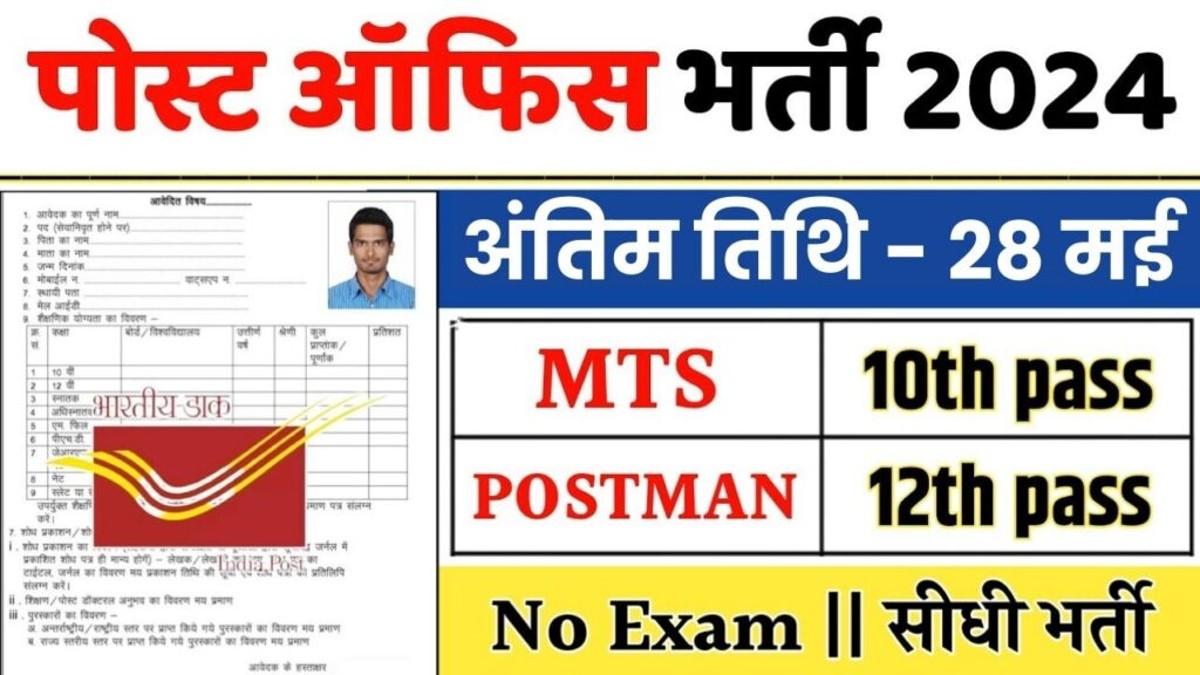

CG SSC Vacancy 2024 Apply Online : कर्मचारी चयन आयोग में कांस्टेबल जीडी के 75768 पदों पर भर्ती, 10वीं/12वीं पास ऐसे करें आवेदन,

CG SSC Vacancy 2024 Apply Online आप इस सरकारी नौकरी अधिसूचना Cg Govt Jobs News से संबंधित सभी जानकारीजैसे वेतनमान, शैक्षणिक योग्यता, आयु सीमा, ...

Read more

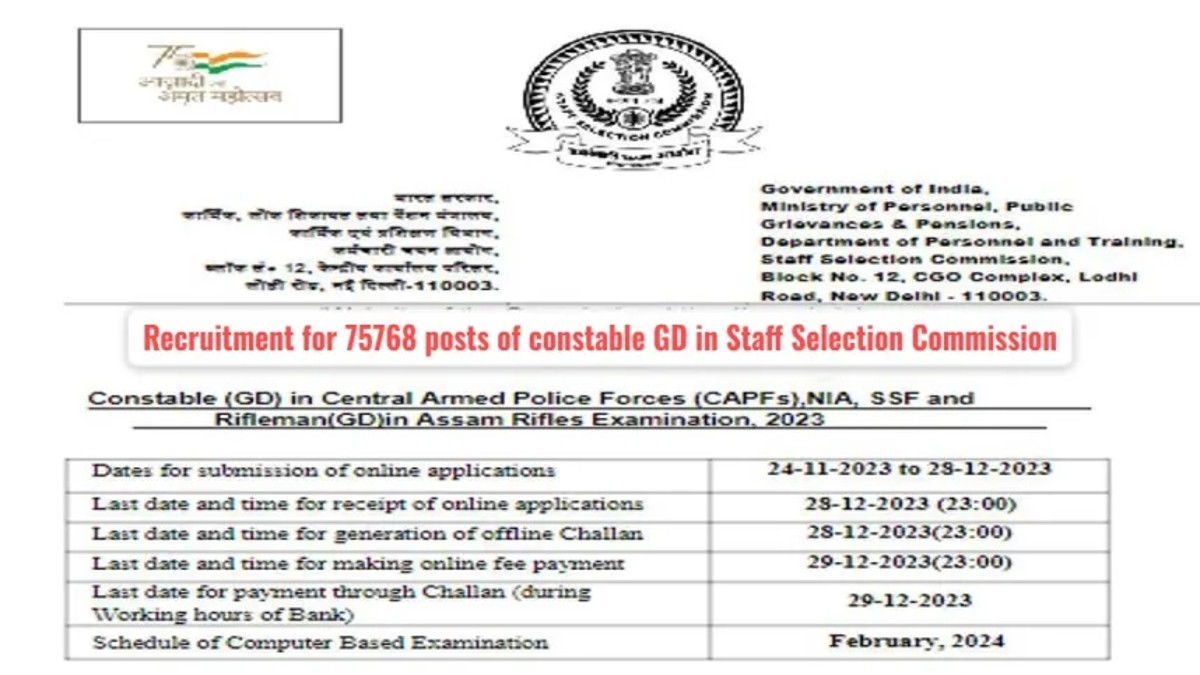

AAI Junior Executive Recruitment 2024, 490 Vacancies, Eligibility, Fee, Apply

एयरपोर्ट अथॉरिटी ऑफ इंडिया ने आर्किटेक्चर, सिविल, इलेक्ट्रिकल, इलेक्ट्रॉनिक्स और आईटी में 490 जूनियर एग्जीक्यूटिव नौकरियों के लिए GATE 2024 भर्ती की ...

Read more

PWD Peon Govt Job शासकीय विभाग में इंजीनियर, क्लर्क, चपरासी, चौकीदार के पदों पर निकली बंपर भर्ती

PWD Peon Govt Job शासकीय विभाग में इंजीनियर, क्लर्क, चपरासी, चौकीदार के पदों पर निकली बंपर भर्ती सभी संबंधितों की ...

Read more

DSSSB Sarkari Vacancy सरकारी विभाग में 5000+ पदों पर निकली सरकारी नौकरी भर्ती

DSSSB Sarkari Vacancy सरकारी विभाग में 5000+ पदों पर निकली सरकारी नौकरी भर्ती दिल्ली अधीनस्थ सेवा चयन बोर्ड (DSSSB) ने ...

Read more

DSSSB Sarkari Result Sarkari Job डीएसएसएसबी टीजीटी और ड्राइंग टीचर 5118+ पदों पर निकली सरकारी नौकरी भर्ती

DSSSB Sarkari Result Sarkari Job डीएसएसएसबी टीजीटी और ड्राइंग टीचर 5118+ पदों पर निकली सरकारी नौकरी भर्ती इस विभाग द्वारा ...

Read more

NHM Latest Job राष्ट्रीय स्वास्थ्य मिशन 5000+ पदों पर भर्ती Sarkari Result

NHM Latest Job राष्ट्रीय स्वास्थ्य मिशन 5000+ पदों पर भर्ती Sarkari Result उत्तर प्रदेश राष्ट्रीय स्वास्थ्य मिशन (UP NHM) ने ...

Read more

UPUMS JOB 2024 यूपीएमएस नर्सिंग ऑफिसर 500+ पदों पर बंपर सरकारी नौकरी भर्ती

UPUMS JOB 2024 यूपीएमएस नर्सिंग ऑफिसर 500+ पदों पर बंपर सरकारी नौकरी भर्ती यूपीएमएस नर्सिंग ऑफिसर भर्ती 2024 – ऑनलाइन ...

Read more